What's Your Business Really Worth?

Take the quick, free Business Value Gap Assessment to find out where your business stands and what’s possible.

Every Business Has Value, But Few Owners Know What Drives It

You’ve worked hard to build your business. Without knowing what the value is and what’s driving (or limiting) it, you’re flying blind.

Many owners discover too late that their business:

- Is worth less than they expected because it depends too much on them

- Could be worth far more with just a few focused improvements

- Has hidden potential they’ve never quantified

Frequently Asked Questions

Q: How long does it take?

About 15-Minutes.

Q: Is it really free?

Yes. There’s no obligation and no hidden costs.

Q: Is it confidential?

Absolutely. Trust is critical in this process and we don’t take it for granted.

Q: What happens next?

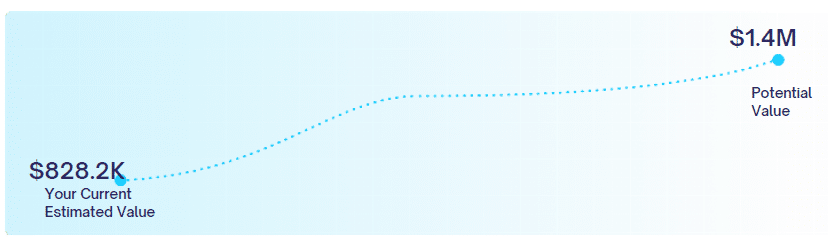

We’ll show you where your business value stands today, what factors are driving or limiting it, and your potential value based on the information you enter.